Views from an Insurance Buff on the Great Meltdown

A Catastrophic event in the Capital Markets aka: The Credit Crisis

Like a rock thrown into a tranquil pond, the subprime mortgage meltdown that kicked off in early 2007 and transformed into a much broader credit market event has spread ripples in ever-widening circles over the intervening year. Yet, unlike the proverbial pebble tossed in a pond, the intensity of the effects seems to have grown as they spread wider and wider. The repercussions have included mounting losses, growing provisioning against losses, big markdowns of mortgage-related securities, falling capital ratios and plummeting share prices.

Since last summer, fear and panic have repeatedly roiled global markets, striking blows at private-label mortgage-backed securities (MBS) and related collateralized debt obligations (CDOs) along with related derivatives, asset-backed commercial paper ( ABCP) and, finally, structured investment vehicles (SIVs).

This post attempts to take a broad brush and helicopter view of the landscape and approaches this event like a catastrophic event with multiple effects. Much like an Earthquake has direct losses but also leads to flooding (Ruptured mains and overflowing lakes), fire ( broken power lines ) and trauma ( Children especially)…

By now the markets have moved from a stage of denial on the scale and duration of the credit crunch. Acceptance is yet to come. The initial upbeat statements that this was a USD 40-50 Billion 1 quarter slowdown that emerged Q3 2007 have given way to larger and more sober estimate. While JPMC, Goldman Sachs and Bill Gross of PIMCO ( A heavyweight Bond player ) estimated between 300-600 Billion of mark to market notional losses the International Stability Forum under the Bank of International Settlements ( BIS) came up with a humbling number of USD 945 Billion. See Side bar below quoting from Forbes note on this.

Most analysts would agree on the three main drivers of the broad credit crisis:

1) Asset Inflation in terms of a sustained boom in Housing prices and other (irrational?) exuberance

2) Lack of Trust between financial counterparties. The musical chair which was the loan spiral where originators sold loans to other who packaged and repackaged them in increasing opaque structures came to a crashing end as the largest financial players stopped trading with each other fearing the liquidity and solvency of their counterparty..

3) Fraud. Already financial institutions (supposedly astute buyers and sellers) are suing each other and lawyers are preparing for a decade of lawsuits. There is plenty of evidence that underwriting standards slipped and slipped a lot in this spiral. There is a lot of speculation that the quarterly financial statements of many banks were wrong and probably deliberately optimistic. Some commentators have seen shades of the Enron saga here. In this view of the events Enron was less an energy trader and more a package-trader of structured products derived from energy asset prices and suffered a bank run

The financial press has picked up Asset Inflation as a cause of the current crisis and similarity to Japan where the ultimate cost of trying to keep banks afloat were close to zero interest rate for years ( even today 0.75%) and a estimated cost of USD 4,000 Billion or 120% of Japan’s average annual GDP over 16 long years.

The financial press has picked up Asset Inflation as a cause of the current crisis and similarity to Japan where the ultimate cost of trying to keep banks afloat were close to zero interest rate for years ( even today 0.75%) and a estimated cost of USD 4,000 Billion or 120% of Japan’s average annual GDP over 16 long years.

What has not yet been picked up is the similarity to the German re-unification in the Lack of Trust and consequent liquidity issues as a cause of the current crisis . When the German Chancellor set the rate of exchange rate between the erstwhile East German currency as 1 : 1 and accepted the assets of the enterprises at their book value he set into motion a huge game of double and triple guessing. Communist Germany did not have much of audited financial statements so many of the mergers (like Allianz buying out the East German Post offices) occurred under opaque conditions. It is estimated that it cost over 2,400 Billion USD over 10 years to restore confidence ie close to 100% of Germany’s average annual GDP over 10 years .

Fraud as the proximate cause and the similarity of the derivates based crisis to the London Excess of Loss Spiral (LMX Spiral) in Lloyds of London has not yet been picked up. Lloyds had a loss of USD 4 Billion over 8 years( starting in the late 80’s) from a core fraud of USD 20 Million.[These are anecdotal numbers from personal sources for Lloyds There is a RAND monograph speculating on the Cost of Korean Re-unification]

The similarities of LMX as derivates and the use of leverage as well as opaque accounting and lack of regulation are very close to the current crisis, almost a prototype . I will expand on this similarity and the reasons for projecting the ultimate net cost of the crisis at over 2,500 Billion and a 4 year development. My guess is the worst is yet to come. Until Insurers who are ultimate holders of much of the credit risk in their bond and pension portfolios start showing severe pain we are still at the beginning of the cycle. AIG has already shown the way and Swiss re in a pre emptive arrangement has secured line of credit equivalent to 20% of its portfolio from Warren Buffet’s Berkshire Hathaway.

Now some of the common features of the credit bubble and LMX Spiral. [ I am not suggesting that Credit Default Swap CDS or other markets are Insurance markets. I am pointing out structural similarity in governance and risk reward that lead to abuse and bubbles…]

Derivatives with Leverage

Excess of Loss ( XL) is a specific type of Reinsurance contract. It is a derivative covering a ceding Insurer ( the buyer of the XL Contract) who buys protection on a specified portfolio of direct insurance contracts from the reinsurer ( the seller of the contract). It has a floor ( Deductible) below which losses suffered by the buyer are not covered and a cap or Limit above which the seller will not pay for losses of the buyer. Thus if National Insurance (NI) is insuring Reliance’s Jam Nagar refinery it may buy a XL contract from GIC for 100Mill x 500 Mill. Thus if there is a covered event like a fire at Reliance’s Jamnagar project and if NI has claims from Reliance exceeding 100 Mill USD then it can call upon GIC to pay those claims ( 100%) up to 500 Mill ie USD 600 Mill looses “from ground up” (FGU) at Jamnagar . XL can be layered similar to tranches in a structured product like Asset Backed Securities ( ABS) . Thus NI can buy a second layer from Swiss Re for 600 x 600 Mill FGU ( From Ground Up) or 0 X600 on Layer 1 so that it is protected up to 1.2 Billion USD losses. Thus in a loss event where losses are up to USD 1.2 billion NI only will have to pay the first 100 Mill. The rest will be recovered from its re insurers 500 Mill from GIC and 600 Mill from Swiss Re. Rates on XL are pretty cheap and upper layers get cheaper running between 100 to 10 basis points.

Thus we can see the derivative nature of XL. It is based on a collection of direct financial instruments (the original policies between insurer and policyholders). It has leverage. Typically the Ceding Insurer will be able to cede 90% of his risks away and only retains 10% so a 10 X leverage. It has call and put option type features.

Credit derivates allow more leverage. It is not unusual in the heady days to have a 100 X exposure. This is 10 times more than Insurance markets

Unregulated Entities with Opaque Accounting and wide global participation

Lloyds of London was set up by a private act of Parliament The Lloyds Act 1871 was updated in 1982. It was only in late 2000 that it was brought under the ambit of the UK regulator the FSA. So during the period of the LMX Spiral ( late 80’s) there was no regulator apart from the Society. Lloyds uses a syndicate structure much like a exchange where members who trade have their own books. Each Syndicate has a agent who manages it and members who provide the capital of the syndicate which backs the risks underwritten by the syndicate. Syndicates used to publish a 3 year rolling account ( the famous non GAAP development accounting) and Profit and Losses for a trading year were finalized 48 months later.

At the base of the credit crisis (more accurately the subprime credit crisis) were the mortgages, packaged into Mortgage Backed Securities (MBS), in turn aggregated into Collateralized Debt Obligations CDOs and CDO-squared. Where they went off balance sheets was in the last stage of CDOs being bundled into multi-layered ABCP (Asset Backed Commercial Paper) issued by SIVs ( Special Purpose Vehicles) and backed by AAA Ratings!!

At this level there was lack of transparency on assets and liabilities valued by opaque models since there are no directly observable prices in the market most of the time as well as severe tenure mismatch (short-term MM borrowings funding long-terms structures) leading to the original liquidity crisis. Both were global and had numerous large and small participants from all parts of the world. We have already learnt at the surprises in Germany at the exposure some of the banks had to the sub prime. We are now beginning to hear of the exotic products bought by Indian corporate

Trading Chains

Re Insurance is global business where reinsurers seek diversification to build a balanced book. Even under normal times there are multiple chains of reinsurance and it is not unusual to have the base risk ( the Jamnagar Factory) pass thru 4-5 parties as each re insurer in turn buy re insurance to protect them-self. This is exactly similar to the capital market players. So while JPMC may have swapped a USD 300 Mill Fixed Interest rate Infrastructure bond for variable LIBOR + 1% Bond it would somewhere else turn around and shed some of the variable rate risk by have a Fixed rate Bond in some other swap. This complex web of contracts makes valuing the ultimate net exposure difficult.

In the LMX Spiral the courts finally got into the act and it was a horror to the market participants to find the chain extending 10-12 deep and most funnily due to aggregation and slicing and dicing of the portfolio quiet often the Insurer has some of his own policies ultimately re insured by himself !!

Capital Markets have similar characteristic. In the early days of this crisis ISDA ( International Swap Dealers Association) estimated the nett loss after netting out counterparties at USD 43 Billion ( Bill Gross of PIMCO’s had estimated of USD 400 Billion of losses). It is worthwhile to note that some observers call this Notional mark to market write downs as they assume the markets will go back after some time. Actuary’s had a long run in with the BASEL II regulators on this. Most pension assets and liabilities are valued at long term interest rates and not adjusted (mark-to-market) for “temporary” market crashes. However they lost the argument and regulators and IFRS ( International Financial Reporting Standards) proposes mark-to-market requirements.

Insures use the term Ultimate Net Loss (UNL) to allow for credits from prior layers of Re insurers and from one’s own re insurers as well as recoveries from scrap and subrogation ( claims from related parties for damages) . It generally takes 8-12 years to fully settle a large claim like a major storm or an earthquake. Settlement cycles are quarterly but Cedeants can make cash calls and get part payments much before the ultimate costs are clear. In the capital markets settlement cycles will be much faster but there is no pre payment. So cash flow or liquidity problems abound even if you have protected yourself by counter swaps. As a Banker noted “… merrily because the river is on average 4 feet deep does not mean we cannot sink in the deep end….”

Greed ,Musical chairs and nonexistent controls and Fraud

At the peak of the LMX spiral Insurers were charging vanishing small rates for taking on risks which they then traded away in their re insurance. Brokers were selling the same pool of risk many times over as Syndicates re insured themselves . In one case properly dissected in the courts after the full 12 cycles of trading were laid out a full 40% of the premiums had gone into commissions. Similarly in Capital markets the risk spread had narrowed considerably ( Credit default swaps at 28 basis points before the crisis compared to 100 bps+ now) but the churning of the trades generated fat margins for the traders.

The Underwriters at a syndicate are supposed to scrutinize the risk and decide the percentage they will take and at what rates. Most were co opted in this scheme. They were incentivized by Sum Insured they wrote and not the profits ( it anyway took three years to “know ” the profits). Some of the leading lights who actually set the benchmark in rating a risk were co-opted by side deals where the broker passed “soft money” to them. This is a complex story and the old boy’s club nature of Lloyds business model and the reason why Lloyds has a dis-investment clause in its constitution today. The parallel to this is the rating agencies like Moody’s making so much money in rating the structured products and become a trifle lax about the risks inherent in these structure. In retrospect it is obvious that a bundle of junk mortgages cannot be AAA merrily because it has been wrapped into an aggregate from a more well rated company ( Municipal Bond Insurers) .

Fraud sent the heated LMX spiral market crashing. It transpired that in a number of cases there were no real risks out there. Similarly the catalyst of the credit crisis was the fraud in lenders trying to pass on bundles of loans which were not really underwritten or backed by any assets or earnings.

Concentration in a few players

To bring these parallels alive I quote from a specialist lawyer describing the LMX Spiral

It is well known that, in general terms, a spiral effect occurs when excess of loss reinsurers extensively underwrite each other’s excess of loss protections. This leads to a transfer of exposures to the same players within the market rather than their dispersal outside the market. The effect of the transfer of exposures was starkly demonstrated by the series of losses which occurred between 1987 and 1990, including UK Storm 87J, the loss of Piper Alpha, and Hurricane Hugo:

- the catastrophe losses were concentrated in a handful of specialist excess of loss syndicates within Lloyd’s rather than evenly dispersed in the market. The four Gooda Walker syndicates, for example, sustained 30 per cent of the entire market’s losses in 1989.

- because the losses were so concentrated, and there was so little “leakage” from the spiral by way of retentions and coinsurance, the catastrophe losses incurred by these specialist syndicates spiralled up and out of the top of their reinsurance programmes. For example, Gooda Walker syndicate 290 suffered a gross loss of US$385 million in respect of Hurricane Hugo against reinsurance protection purchased of US$170 million

- the catastrophe losses had a high ratio of gross to net loss, reflecting the extent to which the losses spiralled. For example, on a gross basis the Piper Alpha loss exceeded by a multiple of 10 the net loss that was covered on the London market.

- traditional methods of rating, whereby the lower or working layers have a higher rate on line than the higher layers to reflect their greater exposure to losses, had no relevance because the higher layers of insurers protections were not significantly less exposed than the lower layers. In the litigation that followed the catastrophic losses, in which the Names on the LMX Syndicates accused their underwriters of negligence, the traditional rating methods adopted by the excess of loss underwriters were revealed as inappropriate to deal with the effect of the spiral.

Those knowledgeable about capital markets trading pattern would know that JPMC held over 40% of default swaps and would have been badly hit if Bear Sterns went under. Similarly most hedge funds have taken funds from the prime brokerage units of these large banks. So in realty there is an enormous concentration of risks within the top 20 global players. The Fed simply would not afford to let a relatively small Broker/Investment bank like Bears Stern fail. Our RBI Governor Mr Y. V Reddy noted in a CNBC interview that what was amazing about the current crisis that the top 20 financial players in the world do not trust the solvency or liquidity of each other. Even more telling is that the RBI and many other central banks have quietly shifted their money market funds ( investments) out to other central banks.

So How bad can it Get?

If we use the LMX Spiral as a model then the maths runs as follows:

For the LMX Spiral ultimate loss of 4 Billion on core fraud losses of 20 Mill or a 200X multiple. Capital markets are 10X more leveraged and assuming core loss is 2 Billion that means gross losses around 4,000 Billion. The International Stability Forum reduced the estimated gross loss of 4,000 billion to a optimistic 1,000 billion assuming liquidity and solvency assistance from central banks. As of now financial institutions have declared around 200 Billion of losses as of 1 April 2008 as tabulated by Bloomberg and plan to raise around 60 billion in new capital.

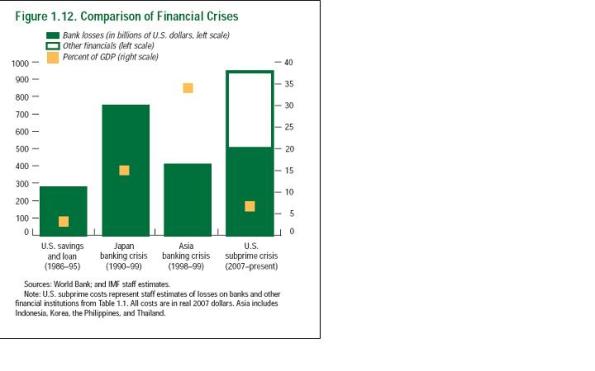

Japan and Germany averaged 10% of GDP as the pain over 10-16 years. Given a 12 Trillion US economy that implies USD 120 Billion per year from quite some time. However just like the savings and loan crisis the US may clean up the mess faster accelerating the losses. Both the IMF and the UK Prime Minister have suggested that the large banks are holding back the real extent of their losses. The consensus estimate is 800 Billion over 4 years or around 20% of the US GDP per year. The IMF estimates this at over 35% of US GDP. See chart .

The fly in the ointment may be the fact that we must keep in mind that Bankers as yet have not started thinking in terms of Maximum Possible Losses (MPL). Banks and much of BASLE II framework is currently skewed towards trading losses. These are gyrations in market values that occur every trading day. Under normal market conditions these fluctuate in small ranges ( 2% for US equities) over a long term trend say an upward growth of around 4-5% real rate after inflation . However what we are witnessing is not normal trading event but a catastrophe event. Much like an Kobe earthquake or a Katrina it will take a fairly long time to see the full costs and the side effect or collateral damage is more expensive then the main loss.

Insurers have had a long history of dealing with catastrophes and have done a reasonable job of estimating ultimate costs . Thus two week after 9/11 insurers were estimating 30-50 Billion direct and another 30-40 billion indirect costs or 60-90 Billion overall. Seven years later the current estimates are a total loss of around 70-90 Billion. It will take a decade for the final sums to be done but the pattern is fairly well established and the net loss is unlikely to exceed 110 Billion.

To contrast HSBC signaled the onslaught of the current credit crisis in Feb 2007 and even as late as October 2007 most bankers were a bit smug about the assumption that this a mere sub prime crisis and will not touch prime and other lending’s . Unfortunately it has and now the real economy is also feeling the heat thru surging inflation.

Insurers distinguish between two concepts. Possible Maximum Loss ( PML) and Estimated Maximum Loss(EML). So in a normal fire or a flood ( 1/5 year event) it is unlikely the whole building will be become useless. Maybe three or four floors near the fire or the ground will be unusable but the rest of the high rise multi tenanted building may be functional. This is EML or losses under normal loss expectancy (Trading losses in capital markets) or maximum foreseeable losses for optimistic traders, managers with short memory ( 180 days trading only !). However under an extreme event ( Great Depression, Katrina, 1/250 year event ) there may be multiple causes of losses. Property, People, Third party and the loss can escalate. For example a fully loaded Jumbo passenger airline represents a possible maximum loss ( PML) around USD 1,000 Million even though the aircraft or hull may be only 70 Million at most. Similarly an earthquake in the Bay area can have PML estimates which are terrifying large and significant compared to the GDP of the US Economy. Capital market players are only now beginning to accept that correlations among asset classes changes under extreme conditions. Thus while geographical diversification reduces risk for normal trading a global meltdown sees all equity markets from Japan, Hong Kong , India and UK lock step with wall street. Consequently Value at Risk (VaR) calculations go terribly wrong and capital requirements end up being underestimated…

Insurers especially reinsurers like Swiss Re and Munich Re tend to think a lot in terms of extreme events and the conditional losses given that extreme events have happened. These are no longer based on probabilities of normal distribution. The banking and Basel II modelers as well as rating agencies are now waking up the need to use expected tail Loss( ETL) in their models for conditional VaR rather than adjusted normal distributions like GARCH . Actuaries may finally be able to get the voice they lost out to stochastic modelers…( but that is another story).

Coming back to the Stability Forum gross estimate of 4,000 Billion is itself optimistic and the publicly announced estimate of USD 1,000 billion is the Minimum Probable loss not the Maximum. That is why this great meltdown may be a seminal event like the great depression creating new institutions and changing old ones….

What does it mean for IT Offshorers ?

Providers are already acting on some obvious consequences. Cost control, better utilization etc. I think there are three points that may be more important

Customers may not be able to predict their Budgets well

Providers are used to working in close partnerships and depend a lot on customer guidance. Providers may need to qualify their estimates as they are also operating in un-familiar terrain

Balanced Portfolio .

Companies need to have more revenue from Non US and non BFSI segment.

Non Intuitive “Bet the Farm” reactions

Conventional wisdom would suggest that AVM contracts are secure. This may not be true. In a previous downturn with a Japanese Insurer the experience was different. During the collapse they cut large AVM projects, went without AMC from IBM on their Mainframes and continued to work with a de supported version of Oracle. However they commissioned a bet the farm type of AD /BPO project setting up Internet self service and massive call centre. These were transformational projects and they negotiated a profit sharing or Fee per transaction processed rather than pay per FTE month.

So providers may miss a bet if they focus on cost reduction part of the equation alone. They should be up there in transformational revenue generating projects with substantial skin in the game…